As March, National Credit Education Month nears, it is an excellent time to educate yourself about the credit management techniques you need to maintain a credit profile generating the best possible credit score.

A good-to-excellent credit profile indicates you take your financial obligations seriously, which means you are more likely to be approved for better financing terms.

If you have had credit issues in the past, know that a subpar score is not a lifelong sentence. With a bit of time, effort, and knowledge, you can begin to repair even the roughest of credit histories and then enjoy the perks of maintaining a good credit score.

The Reasons Why National Credit Education Month Is Important

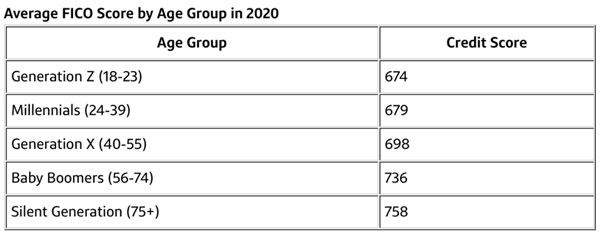

Most consumers find credit scores a bit bewildering. The easiest way to determine how your credit measures up is to see where it falls on a spectrum or range of credit scores. According to the 2020 Credit Review from Experian, these are the average FICO credit scores by age.

How Do You Compare To Your Age Group?

Highlights Ways To Build Credit

National Credit Education Month is a great opportunity to learn how to build a credit profile. Students or young adults will find various programs offered by banks and creditors designed for this specific purpose. These programs include secured credit cards and low-balance credit cards, among others.

Offers A Chance To Improve Your Credit Rating

Credit scores impact your financial life. Maintaining good credit is an important tool for securing manageable interest rates on auto loans, mortgages, and credit cards.

Observing National Credit Education Month

An Annual Reminder To Check Your Credit Score

According to the Consumer Financial Protection Board, each consumer is entitled to a free credit report every twelve months – for each of the three credit repositories. It is essential to understand where your credit falls for several reasons. One’s credit score & profile dictate the terms of credit for the near future. And note that credit can change quickly, which is why you must check it regularly.

In addition, any erroneous information identified on the report can be disputed and corrected.

Focus On Monthly Payment Deadlines

On-time payments contribute significantly to your overall credit score. If you have been remiss in the past, set up a reminder for future payments. Better yet, enroll in a no-cost automatic electronic payment plan, which effectively ensures you will never pay late again.

Share The Knowledge With Your Kids

Parents who prepare their kids to manage their finances and credit do them a great service. Credit cards are often a major contributor to debt problems for young credit users.

How to Improve Your Credit Score

These are some ways to improve your credit score –

- Pay Your Bills As Agreed & On-Time

Credit is based on one simple yet powerful principle – your past credit performance can be used to predict how you manage future credit obligations. - Keep Up The Good Work

The length of one’s good (or bad) credit impacts the credit score. The longer you can maintain on-time payments, the greater the positive impact on your score. - Keep Debt To A Minimum

Credit scores are impacted by one’s credit utilization ratio, which is your combined outstanding credit balances compared to the combined limit of available credit. A credit utilization rate of 30%, or less, is preferred by most lenders. - Only Open New Accounts If Needed

Applying for new credit causes a “hard inquiry” on a credit report, negatively impacting the score.