Loan for debt consolidation

Top Uses for a Loan

Debt Consolidation

Debt consolidation rolls multiple debts, typically high-interest debt such as credit card bills, into a single payment. Debt consolidation might be a good idea for you if you can get a lower interest rate. That will help you reduce your total debt and reorganize it so you can pay it off faster.

If you’re dealing with a manageable amount of debt and just want to reorganize multiple bills with different interest rates, payments and due dates, debt consolidation is a sound approach you can tackle on your own.

Carrying a substantial amount of debt, especially credit card debt, can drag down your credit score and can cause a lack of financial security in your life.

Debt Consolidation Loan Solutions

A debt consolidation loan may be the right debt solution for you if you’re on time with your payments and simply want to reduce the number of payments you have. You don’t have to have excellent credit scores to qualify for a consolidation loan, even those with bad credit may qualify for a debt consolidation loan. Most often, this means a secured loan, a loan that is connected to collateral like your home. Putting something like your home at risk to pay off your creditors can create a problem if something unexpected happens and you are unable to pay your bills – you could face losing your home. However, there is another consolidated debt solution available, an unsecured debt consolidation loan.

With an unsecured debt consolidation loan, you don’t have to risk of any of your assets to get the loan you need to pay off your debts. As long as you are disciplined and aren’t having any troubles in making monthly payments, consolidating your debt with an unsecured loan may work for best you.

How to consolidate your debt

There are two primary ways to consolidate debt (including consolidating credit card debt), both of which concentrate your debt payments into one monthly bill.

- Get a 0% interest, balance-transfer credit card: Transfer all your debts onto this card and pay the balance in full during the promotional period. You will likely need good or excellent credit (690 or higher) to qualify.

- Get a fixed-rate debt consolidation loan: Use the money from the loan to pay off your debt, then pay back the loan in installments over a set term. You can qualify for a loan if you have bad or fair credit (689 or below), but borrowers with higher scores will likely qualify for the lowest rates.

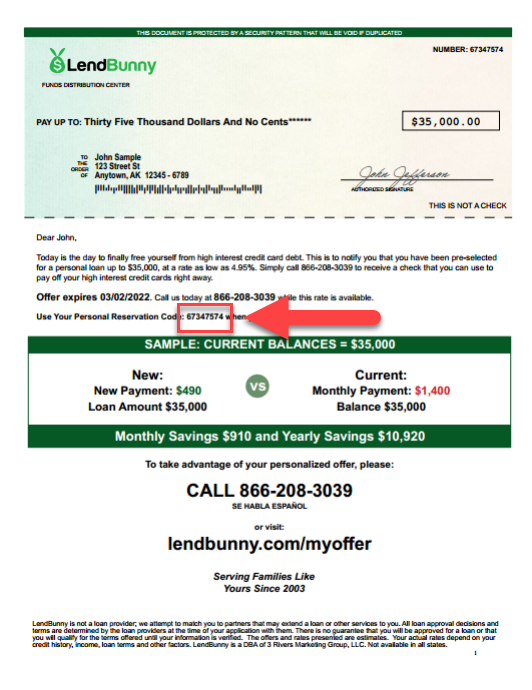

How LendBunny Can Help

At LendBunny, our mission is to work with you to match you with the highly rated debt solutions available in your state. Our free service connects you with industry-leading providers who can help you achieve your financial goal, whether it is becoming debt-free or learning wiser management of your existing debt. In just a few minutes, our free proprietary matching system can help you identify great secured and unsecured debt solutions. Simply answer some easy questions on our debt solutions form.